KUALA LUMPUR: The ringgit prolonged its downtrend to finish lower in opposition to the US greenback right this moment as investors remained cautious amid rising rigidity within the Gaza Strip, an economist stated.

SPI Asset Management managing accomplice Stephen Innes stated the US greenback has gained essential help following larger treasury yields on the again of optimistic US retail gross sales knowledge, which grew 0.7% month-on-month in September.

“The mixture of upper US yields and elevated rigidity within the Middle East after a hospital was hit by a missile of unknown origin has influenced the monetary markets’ response and sealed the gloomy intraday destiny for the ringgit,” he informed eNM.

Nevertheless, Innes famous that China’s better-than-expected third-quarter progress has helped to stabilise the native foreign money from additional depreciation.

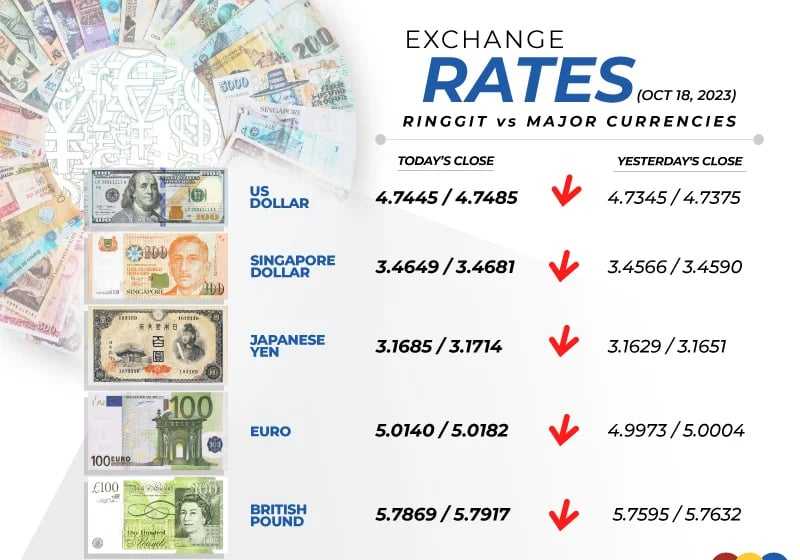

At 6pm, the native foreign money fell to 4.7445/4.7485 in opposition to the buck from yesterday’s shut of 4.7345/4.7375.

The ringgit was additionally traded lower in opposition to a basket of main currencies.

It weakened vis-à-vis the British pound to five.7869/7917 from 5.7595/7632 at Tuesday’s shut, fell in opposition to the euro to five.0140/0182 from 4.9973/5.0004 and was lower in opposition to the yen at 3.1685/1714 from 3.1629/1651 at yesterday’s shut.

Similarly, the native foreign money traded lower in opposition to different Asean currencies.

The ringgit was down in opposition to the Thai baht to 13.0738/13.0914 from 13.0180/13.0319 at yesterday’s shut and eased in opposition to the Indonesian rupiah at 301.5/302.0 from 301.2/301.5 beforehand.

It slipped in opposition to the Singapore greenback to three.4649/3.4681 from 3.4566/3.4590 yesterday and dropped vis-a-vis the Philippine peso to eight.37/8.38 versus 8.34/8.35 yesterday.