KUALA LUMPUR: Bursa Malaysia continued its upward trajectory to shut increased right now buoyed by positive sentiment throughout its regional friends, stated an analyst.

Rakuten Trade Sdn Bhd vice-president of fairness analysis Thong Pak Leng stated main regional indices (Nikkei, Hang Seng Index, and Shanghai Stock Exchange Composite Index) ended increased regardless of the poor in a single day displaying on Wall Street.

He stated world funds have begun to rethink the Asia-Pacific area as a consequence of its comparatively low cost valuations in comparison with different areas on the earth.

“In the meantime, traders eagerly await the discharge of the US Federal Reserve’s most well-liked gauge of inflation, the non-public consumption expenditures (PCE) index, hoping to realize perception into the Fed’s plans for rates of interest forward of subsequent week’s coverage assembly,” he instructed eNM.

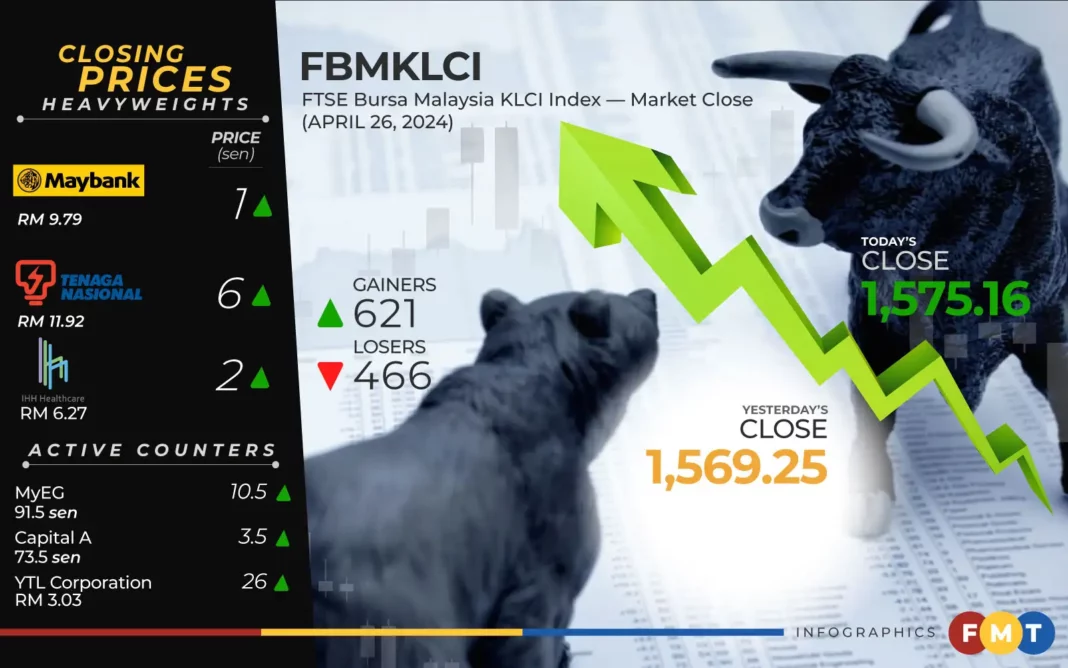

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) rose 5.91 factors to 1,575.16 from yesterday’s shut of 1,569.25.

The benchmark index opened 1.58 factors simpler at 1,567.67 and moved between 1,566.34 and 1,575.57 all through the buying and selling session.

On the broader market, gainers beat decliners 621 to 466 whereas 470 counters had been unchanged, 816 untraded, and 52 others suspended.

Turnover improved to 4.11 billion models value RM3.25 billion from 3.96 billion models value RM2.83 billion yesterday.

Among the heavyweights, Maybank added 1 sen to RM9.79, Tenaga Nasional perked up by 6 sen to RM11.92, IHH Healthcare gained 2 sen to RM6.27, Public Bank eased 2 sen to RM4.21, CIMB slid 7.0 sen to RM6.61.

As for the actives, MyEG added 10.5 sen to 91.5 sen, Capital A gained 3.5 sen to 73.5 sen, YTL Corporation was up 26 sen to RM3.03, whereas BSL Corporation and Hong Seng Consolidated had been flat at 3 sen and 1 sen respectively.

On the index board, the FBM Emas Index rose 45.81 factors to 11,826.79, the FBM 70 Index was 61.48 factors firmer at 16,416.78, the FBMT 100 Index superior 42.98 factors to 11,461.45, the FBM Emas Shariah Index picked up 40.58 factors to 11,991.95, and the FBM ACE Index jumped 47.0 factors to five,062.01.

Sector-wise, the commercial services and products index inched up 0.77 of-a-point to 187.33, the vitality index edged up 6.02 factors to 977.42, the monetary providers index eased 60.14 factors to 17,303.81 and the plantation index decreased 23.1 factors to 7,402.95.

The Main Market quantity elevated to 2.59 billion models valued at RM2.92 billion versus 2.48 billion models valued at RM2.51 billion yesterday.

Warrants turnover surged to 1.06 billion models value RM157.29 million towards 977.13 million models value RM141.19 million yesterday.

The ACE Market quantity shrank to 452.36 million shares value RM167.36 million from 501.52 million shares value RM177.04 million beforehand.

Consumer services and products counters accounted for 346.37 million shares traded on the Main Market, industrial services and products (549.01 million), building (202.36 million), expertise (722.34 million), SPAC (nil), monetary providers (83.42 million), property (224.77 million), plantation (21.87 million), REITs (21.1 million), closed/fund (53,600), vitality (135.93 million), healthcare (45.42 million), telecommunications and media (32.83 million), transportation and logistics (52.73 million), utilities (144.02 million), and enterprise trusts (4.55 million).