KUALA LUMPUR: Bursa Malaysia ended the week on a softer word in step with regional bourses, mirroring the global market downturn as the US Federal Reserve (Fed) chairman Jerome Powell expressed doubts about US rates of interest’ effectiveness in curbing inflation.

Rakuten Trade Sdn Bhd vice-president of fairness analysis Thong Pak Leng reckoned the persistently excessive charges and yields have performed a central position in steering the inventory marketplace for months, inflicting a downturn in funding costs, slowing financial exercise and rising strain on the monetary system.

“Having mentioned that, we imagine the benchmark has remained oversold and anticipate it to stage a rebound anytime quickly, backed by a constant inflow of international shopping for assist.

“On a technical perspective, the FTSE Bursa Malaysia KLCI (FBM KLCI) Index has declined for 4 consecutive days, hinting at profit-taking actions and a potential continuation of decrease costs,” he informed eNM.

Nonetheless, Thong opined that the outlook for Malaysian equities will stay secure, supported by their enticing valuations, stronger company earnings, and improved financial circumstances.

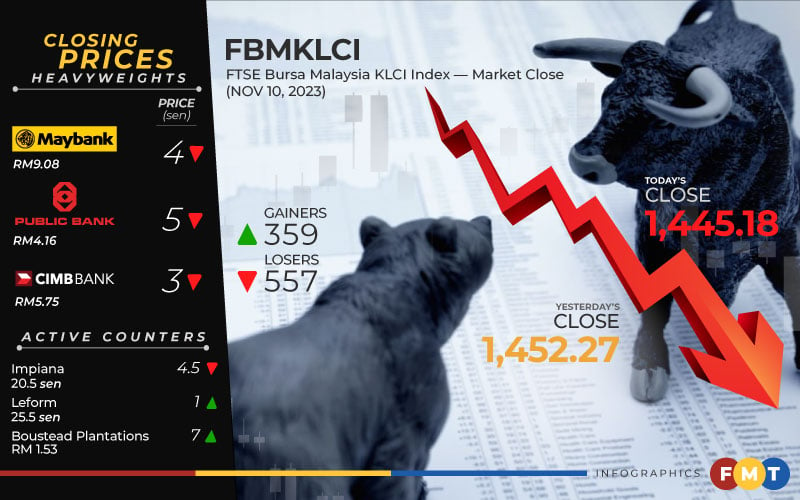

At 5pm, the FBM KLCI fell by 0.48%, or 7.09 factors, to shut at 1,445.18 from yesterday’s closing of 1,452.27.

The index opened 1.71 factors simpler at 1,450.56 and moved between 1,425.01 and 1,451.22 all through the day.

On the broader market, decliners trumped gainers 557 to 359, whereas 437 counters had been unchanged, 1,021 untraded, and 20 others suspended.

Turnover narrowed to three.19 billion items valued at RM1.61 billion from yesterday’s 3.32 billion items valued at RM1.94 billion.

Among the heavyweights, Maybank misplaced 4 sen to RM9.08, Public Bank fell 5 sen to RM4.16, CIMB decreased 3 sen to RM5.75, and Petronas Chemicals was 1 sen decrease at RM7.19, whereas Tenaga Nasional added 2 sen to RM9.92.

Of the actives, Hong Seng and Widad had been flat at 4.5 sen and 45.5 sen, respectively, and Impiana slid 4.5 sen to twenty.5 sen, Leform gained 1 sen to 25.5 sen, and Boustead Plantations rose 7 sen to RM1.53.

On the index board, the FBM Emas Index trimmed 51.56 factors to 10,691.47, the FBMT 100 Index shed 50.98 factors to 10,353.59, the FBM Emas Shariah Index fell 48.71 factors to 10,897.17, the FBM 70 Index tumbled 70.56 factors to 14,161.93, and the FBM ACE Index slipped 26.58 factors to five,132.65.

Sector-wise, the industrial services index went down 0.72 of-a-point to 172.4, the plantation index dropped 1.1 factors to six,922.29, the power index dipped 2.19 factors to 859.34, and the monetary providers index dwindled 69.44 factors to 16,296.07.

The Main Market quantity was marginally decrease at 2.11 billion items value RM1.37 billion in contrast with yesterday’s 2.26 billion items value RM1.71 billion.

Warrants turnover rose to 385.17 million items valued at RM51.22 million from 370.43 million items valued at RM53.15 million yesterday.

The ACE Market quantity improved to 677.09 million shares value RM184.83 million from 665.88 million shares value RM178.7 million beforehand.

Consumer services counters accounted for 504.68 million shares traded on the Main Market, industrial services (360.06 million); development (102.17 million); expertise (463.84 million); SPAC (nil); monetary providers (34.39 million); property (170.6 million); plantation (63.77 million); REITs (5.9 million), closed/fund (8,000); power (116.15 million); healthcare (67.91 million); telecommunications and media (25.63 million); transportation and logistics (90.32 million); and utilities (100.62 million).

On a separate word, Bursa introduced that the change and its subsidiaries might be closed on Monday, Nov 13, 2023, along side the Deepavali public vacation.

Monday is a alternative vacation for Deepavali which falls on Sunday, Nov 12.

“Bursa and its subsidiaries will resume operations on Tuesday, Nov 14, 2023.