Just three weeks in the past, I woke as much as a headline that I discovered unsurprising, given Malaysia’s monitor file in relation to new, disruptive expertise, but deeply disappointing. It learn: Bursa Malaysia says no to cryptocurrency on multi-asset exchange.

Let’s have a look at Bursa Malaysia CEO Muhamad Umar Swift’s causes for this stance and why I feel Bursa is probably squandering a generational alternative.

Opportunity and worth

Reason 1: Bursa’s targets revolve round creating alternatives and rising worth, and cryptocurrency does neither.

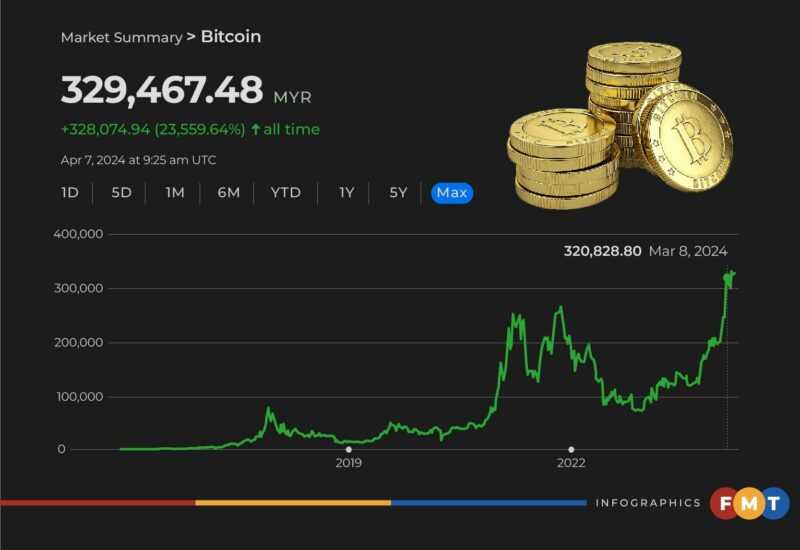

Counter argument: Bitcoin, the primary and largest cryptocurrency on the earth, has a market capitalisation of a whopping US$1.37 trillion (RM6.5 trillion). A single bitcoin was value round RM320,000 on April 14 and it has gone up in opposition to the ringgit by about 23,000% since its inception in 2008 (sure, you learn that proper) as proven beneath:

Bitcoin is now the ninth largest asset on the earth by market capitalisation, bigger even than Meta (previously Facebook) and inside hanging distance of Google, as proven beneath:

Bitcoin can be 56 occasions bigger than Maybank, essentially the most precious publicly listed Malaysian firm. If this doesn’t depend as “rising worth”, I don’t know what does.

If we examine bitcoin to fiat currencies, it’s the thirteenth largest foreign money on the earth, bigger even than our ringgit and the Singapore greenback, as proven beneath:

In addition, it’s estimated that bitcoin has created round 40,000 millionaires (denominated in US greenback). If we embody the cryptocurrency trade usually, this quantity balloons to round 88,000. If this doesn’t depend as “creating alternatives”, I don’t know what does.

Plus, asserting that cryptocurrencies don’t create alternatives and develop worth is very jarring once we contemplate that the primary asset Bursa included in its newly launched multi-asset alternate was gold.

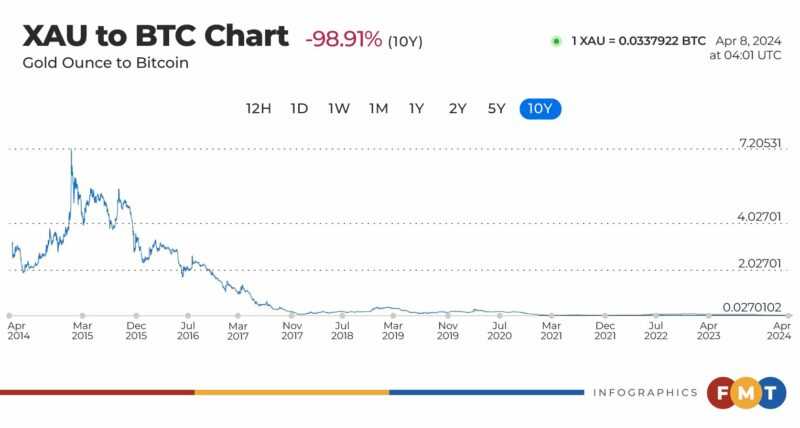

Sure, gold is an honest retailer of worth nevertheless it has carried out abysmally in opposition to bitcoin, depreciating in opposition to it by nearly 99% simply prior to now 10 years, as proven beneath:

Surely if gold is an appropriate funding instrument, an asset that has vastly outperformed the valuable steel needs to be as effectively?

Asset worth

Reason 2: Cryptocurrency will not be an actual asset, it doesn’t have any intrinsic worth.

Counter argument: Let’s study the case for bitcoin first. Like fiat currencies such because the ringgit and greenback, Bitcoin has no intrinsic worth.

Fiat currencies have worth as a result of governments dictate that they do and this edict is defended by males with weapons.

Bitcoin, nonetheless, doesn’t rely upon such coercion. Rather, it has worth as a result of folks consider it has worth because of it possessing these qualities and extra:

1) Hard provide cap of 21 million cash, making it an inflation-resistant retailer of worth;

2) Can be transacted with by anybody from anyplace on the earth, making it censorship-resistant;

3) The community has by no means been hacked, making it a safe financial institution in our on-line world, and

4) Can’t be managed or co-opted by anybody or any entity, making it nation-state-resistant.

Further, bitcoin derives worth by upending the presently fractured monetary system and offering a unified answer.

It is a bearer asset (supplanting gold), it’s a foreign money (supplanting fiat currencies), it’s a financial institution in our on-line world (supplanting industrial banks), it gives a predictable, rules-based financial order (supplanting central banks), permits cross-border transfers (supplanting the inter-bank Swift system), and permits real-time funds by way of L2s (supplanting the Visa and Mastercard networks).

And in relation to sensible contract-based cryptocurrencies — Ethereum and Solana being the preferred ones — their worth may be ascertained the way in which the values of typical corporations are.

The main distinction between them and a traditional firm is that as a substitute of offering a collection of services or products, these crypto networks present a base substrate or platform that different crypto protocols can use to create worth.

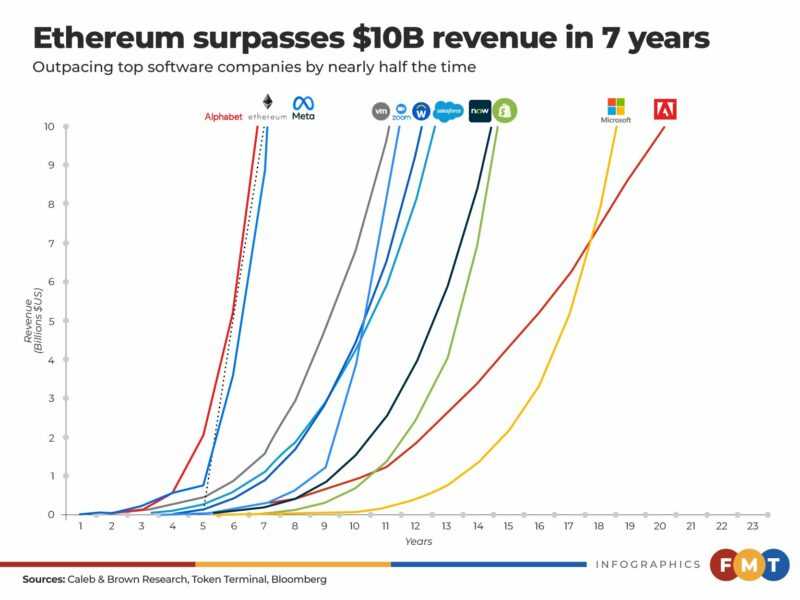

Just final 12 months, Ethereum surpassed US$10 billion in income, reaching this feat quicker than tech heavyweights Meta, Zoom, Microsoft and Shopify, as proven beneath:

Solana, a youthful, quicker and lower-cost crypto protocol, has generated US$134 million in charges simply this previous 12 months, whereas repeatedly hitting greater than one million energetic customers every day.

With such metrics pointing to their adoption, how can anybody say that cryptocurrencies don’t have any worth?

Economic advantages

Reason 3: All our merchandise come again into the economic system. I should not have that decision for crypto. Crypto is simply crypto.

Counter argument: Many crypto protocols have real-world use-cases and are available again into the economic system. Let’s have a look at a few of them.

1) Bitcoin is a hedge in opposition to the ceaseless debasement of the ringgit. It can defend odd, hardworking Malaysians from having their life financial savings worn out because of central financial institution cash printing.

This improve in wealth might allow Malaysians to improve their lifestyle in the event that they select to by buying extra real-world objects, therefore boosting the economic system.

2) Helium is a pioneer of a newly budding subject in crypto known as Decentralised Physical Infrastructure (DePIn).

It launched an Uber reasonably priced cellphone plan which solely prices US$20 a month per consumer, undercutting plans supplied by main US cellular carriers akin to Verizon and AT&T.

It bootstrapped the buildout of the community by promoting “hotspot miners” which enabled patrons to earn a reward in its token.

3) Render Network is the world’s first decentralised graphic processing unit (GPU) rendering platform. It has created a blockchain-based market the place customers can utilise idle GPU capability to serve their AI and rendering wants from anyplace on the earth at a fraction of the price of typical strategies.

4) Farcaster is a brand new decentralised, censorship-resistant, peer-to-peer social community that seems like a hybrid between X (previously Twitter) and Reddit. It boasts 80,000 every day energetic customers and simply raised a brand new funding spherical, valuing it at US$1 billion.

5) Hivemapper sells dashcams that contributors set up on their vehicles to offer it with the freshest maps of the street. In return for offering this map knowledge, contributors receives a commission within the Hivemapper community’s native token.

Hivemapper then sells this map knowledge to corporations that want up-to-date photographs and maps of the world. Its nearly 120,000 contributors have helped it map 10.3 million distinctive kilometres all around the world.

6) Tether, the world’s largest stablecoin issuer is now value north of US$100 billion (greater than 4 occasions bigger than Maybank) and made US$6.2 billion final 12 months — greater than Goldman Sachs and Blackrock.

Tether is now a prime 22 purchaser of US treasuries — whose use is to fund US authorities operations.

Raising capital, making earnings

Reason 4: Bursa’s function is to assist corporations elevate capital, broaden, make use of folks and make revenue. Crypto doesn’t do this, it doesn’t fulfil that fundamental premise. It is buying and selling for the sake of buying and selling.

Counter argument: As amply demonstrated above, there are many actual crypto corporations which might be elevating capital, increasing, using folks and making revenue.

And that is simply the tip of the iceberg. There are many extra crypto corporations which might be making some huge cash.

Sure, there are many cryptocurrencies that serve no different function than to gamble and speculate on — memecoins being the first ones — however to say cryptocurrencies as an asset class are simply “buying and selling for the sake of buying and selling” is straight-up inaccurate.

Closing ideas

Bursa has a golden alternative right here. By permitting folks to put money into the preferred cryptocurrencies akin to bitcoin, Ethereum and Solana straight within the Bursa multi-asset alternate, they’ll entice an immense pool of liquidity that will probably be domiciled in Malaysia, and be a part of Malaysia’s capital market.

Its recognition is clearly demonstrated by the truth that the newly launched bitcoin ETFs (exchange-traded funds) within the US — spearheaded by monetary behemoths Blackrock (US$10.5 trillion property underneath administration) and Fidelity (US$4.5 trillion property underneath administration) — have develop into the fastest growing ETFs of all time, giving them custody over US$57 billion.

Other main economies are following go well with on the again of its unimaginable recognition. Hong Kong is more likely to approve its bitcoin and Ethereum ETFs this month and South Korea’s newly elected authorities has vowed to permit residents entry to the US bitcoin ETFs.

But since not one of the exchanges in Southeast Asia have made such a transfer, Bursa can develop into a pioneer within the area by permitting entry to bitcoin and different cryptocurrencies.

After all, it’s about time Malaysia stopped being a follower and began changing into a pacesetter.

The views expressed are these of the author and don’t essentially replicate these of eNM.