KUALA LUMPUR, Nov 29 — In the corridors of upper schooling, the affect of forex fluctuations is leaving an indelible mark on the goals of many Malaysian students pursuing research overseas.

With the ringgit’s latest downward spiral, students like Kaushna Rajendran and Zarith Sofea Ann Abdullah say they’re grappling with the truth of elevated schooling prices and the challenges that include it.

Kaushna, a 23-year-old regulation scholar at BAC University in her last 12 months on the University of Hertfordshire, United Kingdom, mentioned that the rise in charges for her twinning programme have elevated notably since her preliminary inquiry in 2019.

“I bear in mind once I first inquired concerning the twinning programme again in 2019 at BAC, the costs have been undoubtedly decrease than what they’re now.

“Even when my brother did his twinning programme three years in the past for the identical course, and it was far more reasonably priced again then. It’s stunning to see how a lot the charges have risen in only a few years,” she instructed eNews Malaysia.

She additionally mentioned that with ringgit’s depreciation, the prices of schooling have surged, including stress on her mother and father.

“Now, my mother and father should fork out extra money for me to pursue the identical programme. It’s not straightforward, particularly with the present financial circumstances and the forex depreciation,” she added, underscoring the broader financial challenges impacting households.

Echoing the sentiment, Zarith mentioned the financial strain goes past tuition charges.

“Everything appears dearer from lodging, and books to every day bills. It’s making me rethink some elements of pursuing this twinning programme,” expressed the 22-year-old from Taylor’s University, presently in her second 12 months of enterprise administration at Queen’s University Belfast, United Kingdom.

In a bid to cushion the financial affect, Zarith has taken up part-time work, a difficult juggling act together with her educational obligations.

“We want the schooling, however the prices and the time commitments are making it extremely difficult. That’s why I’ve taken up a part-time job at my college as nicely,” she confessed.

The unsure financial local weather has additionally forged a shadow over her future plans.

“Initially, I used to be planning on doing my grasp’s programme right here, however with the financial uncertainties, it seems like we’re consistently on edge about how far more the charges would possibly improve sooner or later. It’s onerous to plan for the long run,” Zarith mentioned.

The results of forex depreciation on schooling prices isn’t just a financial matter however a crossroads the place goals and financial realities intersect.

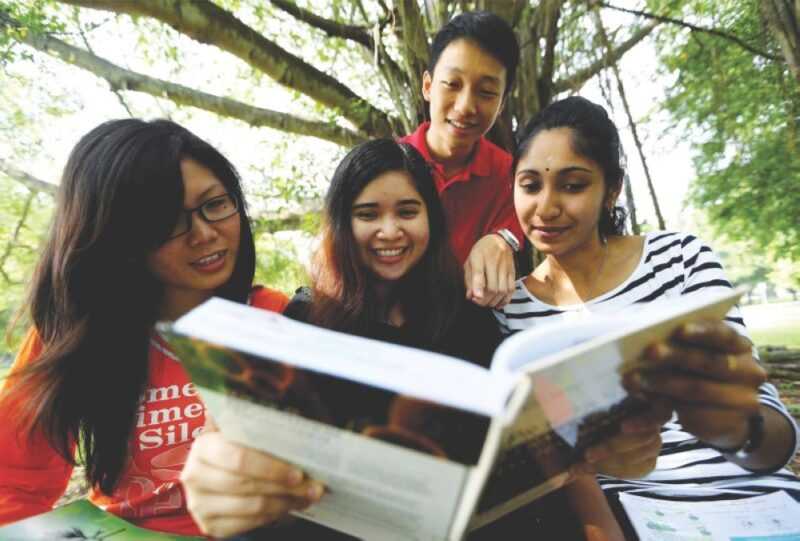

According to latest analysis performed by Wise, a UK-based foreign alternate financial service, Malaysians learning overseas face an annual overpayment of roughly RM69.9 million in whole switch charges. — Picture by Farhan Yusoff

According to latest analysis performed by Wise, a UK-based foreign alternate financial service, Malaysians learning overseas face an annual overpayment of roughly RM69.9 million in whole switch charges.

The examine, encompassing practically 60,000 Malaysian students learning abroad, indicated a median annual lack of RM1,183 per scholar as a consequence of transfer-related charges.

The analysis by the worldwide know-how firm additionally highlighted that worldwide students globally expertise an annual overpayment of round RM5.3 billion in hidden switch charges when shifting cash throughout borders.

The examine revealed that Malaysian students make investments probably the most in schooling within the United States (US), averaging RM130,470 per 12 months, surpassing the worldwide common.

Australia and the United Kingdom, each among the many prime 5 schooling locations for Malaysian students, have been additionally recognized as costly international locations to review in, with annual prices ranging between RM65,665 and RM77,221, in response to Wise’s inside knowledge.

Private increased schooling establishments are additionally grappling with elevated working prices, prompting a cascade of results on students, establishments, and the schooling sector as a complete.

Speaking to eNews Malaysia, National Association of Private Educational Institutions (Napei) secretary normal Teh Choon Jin mentioned the depreciation of the ringgit has led to a notable decline in students pursuing schooling overseas, affecting their plans as a consequence of elevated prices.

“There has been a provide and demand paradigm shift by way of outbound the place fewer students are opting to go abroad as a result of mother and father should pay extra as a consequence of depreciation of our forex and their plan for abroad schooling is changing into unaffordable.

“Many who’ve deliberate to go abroad are actually opting to remain in Malaysia for their increased schooling,” he mentioned.

He mentioned in distinction, there was a surge in worldwide students enrolling in Malaysian increased academic establishments, attracted by the perceived affordability, partly attributed to the depreciating worth of the ringgit.

He additionally mentioned that for students enrolled in twinning programmes in Malaysia, charges stay in ringgit, however once they go overseas to finish their programmes, they’re required to pay within the host nation’s forex, resulting in elevated financial strain.

Similarly, students endeavor exterior programmes with charges denominated in foreign currencies, such because the British pound, discover themselves paying extra as a result of weakened ringgit.

The depreciation of the ringgit is inflicting inflationary pressures for households within the low to mid M40 revenue brackets, diminishing their disposable revenue. As a outcome, households are exploring different pathways for increased schooling, together with contemplating public universities, establishments with decrease charges, or coming into the job market instantly. — Picture by Ahmad Zamzahuri

He additionally highlighted the rising working prices confronted by non-public increased schooling establishments in Malaysia, pushed by the fixed upgrading of kit, software program, and {hardware}.

Choon Jin mentioned nearly all of these bills are incurred in foreign forex, notably the US greenback, resulting in a rise in working prices exacerbated by the depreciating worth of the ringgit.

“The depreciation of the ringgit is inflicting inflationary pressures for households within the low to mid M40 revenue brackets, diminishing their disposable revenue.

“As a outcome, households are exploring different pathways for increased schooling, together with contemplating public universities, establishments with decrease charges, or coming into the job market instantly,” he added.

Recognising these challenges, the Napei emphasised the necessity for enhanced authorities help to allow entry to increased schooling for households throughout the low to mid-M40 revenue brackets.

However, Choon Jin mentioned the choice to revise tuition charges is a multifaceted course of that includes varied components, extending past mere fluctuations in forex values.

“Private increased academic establishments should undertake a complete evaluate of their price constructions to make sure each sustainability and accessibility of schooling. Relying solely on forex values is inadequate; subsequently, a holistic method is important,” he mentioned.

To tackle the challenges posed by forex depreciation, he mentioned non-public increased schooling establishments are collaborating with foreign universities within the Asia area to offer reasonably priced alternate programmes and examine overseas alternatives.

“Under such agreements, students make tuition price funds to their respective house universities for the alternate programmes. Incidental bills, akin to journey, lodging and dwelling prices, grow to be the first financial accountability for the students.

“In addition to bodily alternate programmes, non-public increased schooling establishments are adapting to the present circumstances by incorporating digital worldwide experiences. This digital mobility programme turned notably outstanding throughout the pandemic when journey restrictions have been in place. This different permits students to interact in cross-cultural experiences with out the necessity for bodily journey,” he mentioned.

He added that some non-public increased schooling establishments are providing shorter-duration examine overseas choices.

“For occasion, programmes designed to align with summer season holidays in abroad universities for Malaysian students to review overseas programme present a extra manageable timeframe and price for participation.

“These initiatives are strategically applied to ease the financial burden related to forex depreciation, making certain that Malaysian students can nonetheless profit from useful worldwide academic experiences,” he mentioned.

The ringgit ended buying and selling yesterday at 4.67 towards the US greenback.