KUALA LUMPUR, Sept 21 — Former prime minister Datuk Seri Najib Razak in 2014 received RM4 million of funds originating from a 1Malaysia Development Berhad (1MDB) subsidiary’s US$250 million financial institution loan, with the money funnelled to him by firms managed by Malaysian fugitive Low Taek Jho’s affiliate Eric Tan Kim Loong, a money trail produced in the High Court confirmed.

Adam Ariff Mohd Roslan, an analyst at Bank Negara Malaysia, mentioned this when laying out the money trail because the forty seventh prosecution witness in Najib’s trial.

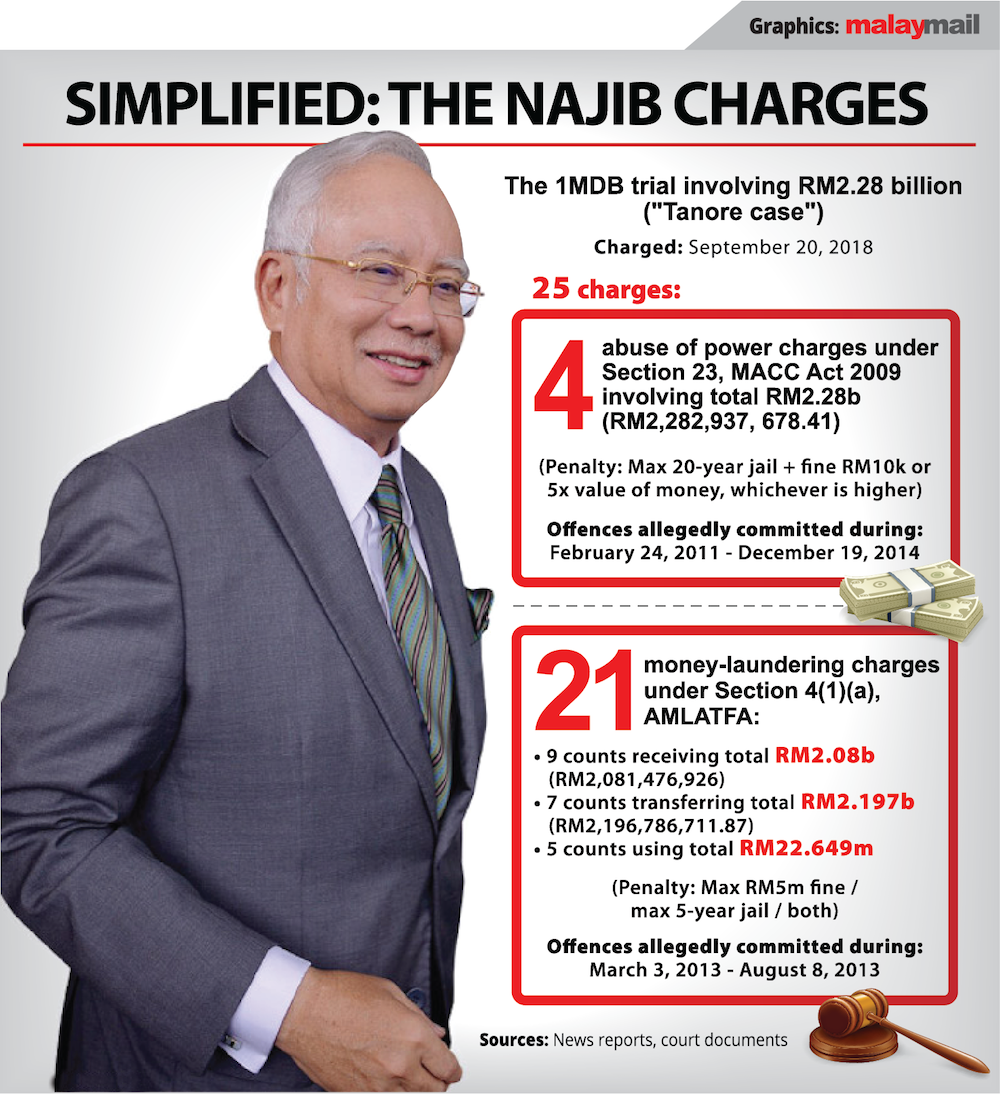

Najib is going through 25 fees over the misappropriated RM2.28 billion of 1MDB funds mentioned to have entered his non-public AmIslamic financial institution accounts in 4 phases of the alleged 1MDB scheme.

Basing the money trail on a number of banking paperwork, Adam Ariff mentioned that 1MDB unit 1MDB Energy Holdings Limited (1MEHL) had on May 26, 2014 took a US$250 million loan from Deutsche Bank, with over US$239.9 million of the loan proceeds then getting into its 1MEHL’s Falcon Bank account on May 28, 2014.

Money from 1MEHL’s US$250 million loan was then handed round to 3 completely different financial institution accounts in more and more smaller quantities and adjusted arms in 4 transactions, earlier than lastly touchdown in Najib’s private AmIslamic checking account which carried the codename “AmPrivate Banking-1MY”, the money trail confirmed.

All these cross-border transactions — which resulted in money borrowed by 1MEHL ending up in Najib’s account — befell inside lower than a month, the money trail confirmed.

After receiving the US$239 million on May 28, 2014, 1MEHL on about the identical day instructed its financial institution to switch US$175 million to the BSI Bank account of British Virgin Islands-incorporated Aabar Investments PJS Limited (now recognized to be a faux firm with a strikingly comparable title to the precise Abu Dhabi-incorporated agency Aabar).

On June 17, 2014, US$19 million was despatched out by the faux Aabar to Affinity Equity International Partners Limited’s DBS Singapore checking account.

On June 19, 2014, Affinity Equity withdrew US$1.89 million and despatched the funds to Blackrock Commodities (Global) Limited’s DBS Singapore checking account.

Upon receiving the US$1.89 million on June 19, 2014, Blackrock on the identical day despatched British kilos 750,000 to Najib’s “AmPrivate Banking-1MY” account. (This was equal to US$1,277,250 or over US$1.277 million.)

The 750,000 British kilos was transformed to RM4,093,500 or barely over RM4 million earlier than being banked into Najib’s AmPrivate Banking-1MY account by June 23, 2014.

Based on the account’s financial institution assertion, Adam Ariff mentioned Najib’s AmPrivate Banking-1MY had RM100,000 earlier than the RM4 million sum got here in.

This is a part of the fourth part.

Asked by deputy public prosecutor Kamal Baharin Omar, Adam Ariff referred to a number of paperwork together with financial institution paperwork which confirmed that Tan Kim Loong was named as the only real account consumer and the beneficiary proprietor and sole authorised signatory for the DBS financial institution accounts for each Affinity Equity and Blackrock.

Low is best often known as Jho Low, and the prosecution on the primary day of trial had described Tan as Low’s “shadow” and Low as Najib’s mirror picture and alter ego.

Bank Negara Malaysia analyst Adam Ariff Mohd Roslan is pictured on the Kuala Lumpur Court Complex September 21, 2023. — Picture by Firdaus Latif

Earlier this week, Adam Ariff laid out the money trail for first and second part of the 1MDB scheme, saying that the RM60 million and RM90 million which have been despatched to Najib’s AmIslamic account with the codename “AmPrivate Banking-MR” in 2011 and 2012 respectively might all be traced again to funds belonging to 1MDB and 1MDB’s subsidiary 1MDB Energy (Langat) Limited’s (1MELL).

The first part noticed US$20 million or RM60 million of 1MDB funds travelling by Low’s firm Good Star Limited’s RBS Coutts checking account and to a checking account belonging to a “Prince Faisal bin Turki bin Bandar Al Saud” earlier than it reached Najib’s account which had RM484 as its steadiness then, whereas the second part noticed US$30 million or RM90 million of 1MELL’s funds flowed by accounts together with Jho Low’s affiliate’s Tan’s Blackstone Asia Real Estate Partners’s account earlier than reaching Najib’s account.

As for the third part, Adam Ariff had yesterday confirmed how US$681 million from a US$2.72 billion debt taken on by 1MDB subsidiary 1MDB Global Investments Limited (1GIL) was funnelled out for purported investments, solely to finish up passing by Jho Low’s affiliate Tan’s two firms Granton Property Holding Limited and Tanore Finance Corp earlier than ending up in Najib’s “AmPrivate Banking-MR” account in 2014. Najib’s account had over RM879 million earlier than the US$681 million (RM2.081 billion) got here in.

On the primary day of trial, the prosecution had mentioned it will present that 1MDB funds had been transferred in a number of transactions to Najib’s accounts, specifically US$20 million equal to RM60,629,839.43 or over RM60 million from the primary part, US$30 million equal to RM90,899,927.28 or over RM90 million (second part), US$681 million equal to RM2,081,476,926 or over RM2 billion (third part), and transactions in British pound that have been equal to RM4,093,500 and RM45,837,485.70 or a mixed complete of RM49,930,985.70 million or over RM49 million (fourth part).

Najib’s 1MDB trial is being heard earlier than choose Datuk Collin Lawrence Sequerah.