KUALA LUMPUR: Bursa Malaysia snapped its six-day successful streak to shut lower immediately on profit-taking actions in commodity-related and gaming shares following the current rally, mentioned an analyst.

Rakuten Trade Sdn Bhd fairness analysis vice-president Thong Pak Leng mentioned the important thing regional indices had been additionally principally lower following a combined efficiency on Wall Street, which was hit by the slide in expertise shares.

He mentioned buyers are adopting a wait-and-see method forward of the worldwide earnings season.

“Meanwhile, Meta Platforms Inc’s disappointing outlook has sparked issues about whether or not the business, which has fuelled the bull market in equities, has stretched too skinny.

“Interest is now directed in the direction of the Bank of Japan,” he informed eNM.

Back residence, Thong mentioned he interprets immediately’s sell-down as a wholesome correction, permitting the market to take in the current uptrend and presenting a beneficial alternative to accumulate shares at lower ranges.

“We maintain our view that if the benchmark index is in a position to constantly keep above the 1,570 degree for a longer interval, there may be a larger likelihood of additional advances.

“Hence, we anticipate the FTSE Bursa Malaysia KLCI (FBM KLCI) to development throughout the 1,565-1,575 vary in the direction of the weekend,” he added.

In addition, UOB Kay Hian Wealth Advisors’ designated portfolio supervisor and head of wealth analysis and advisory Sedek Jantan mentioned regardless of immediately’s minor decline within the FBM KLCI after hitting a two-year excessive yesterday, the market sentiment has proven notable resilience.

He mentioned the index, which hit an intraday excessive of 1,574.45 immediately, encountered a modest retreat, but this underscores the inherent energy of the native market.

“We stay optimistic relating to the prospects of the Malaysian market’s ongoing rally.

“Our confidence is bolstered by the projected progress in commerce actions, pushed by a resurgence in Malaysia’s electrical and electronics sector, alongside an uptick in commodity manufacturing,” he mentioned.

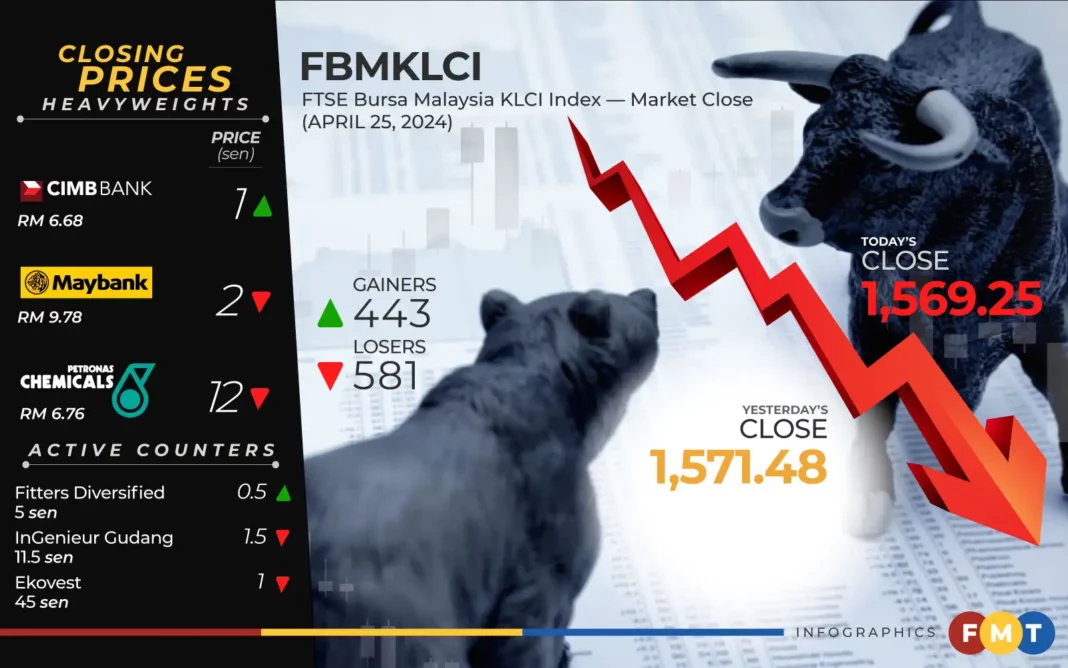

At 5pm, the FBM KLCI eased 2.23 factors to 1,569.25 from yesterday’s shut of 1,571.48.

The benchmark index, which opened 1.81 factors higher at 1,573.29, moved between 1,569.03 and 1,574.45 all through the buying and selling session.

On the broader market, decliners beat gainers 581 to 443 whereas 535 counters had been unchanged, 807 untraded, and 22 others suspended.

Turnover declined to 3.96 billion models price RM2.83 billion from 4.25 billion models price RM3.03 billion yesterday.

Among the heavyweights, CIMB added one sen to RM6.68, Maybank and Public Bank dipped two sen every to RM9.78 and RM4.23 respectively, Petronas Chemicals slid 12 sen to RM6.76, whereas Tenaga Nasional was flat at RM11.86.

As for the actives, Berjaya Corporation edged up one sen to 29.5 sen, Fitters Diversified inched up 0.5 sen to 5 sen, InGenieur Gudang misplaced 1.5 sen to 11.5 sen, Ekovest shed one sen to 45 sen, whereas Sapura Energy was flat at 4.5 sen.

On the index board, the FBM Emas Index fell 19.51 factors to 11,780.98, the FBM 70 Index eased 27.01 factors to 16,355.3, the FBMT 100 Index gave up 16.91 factors to 11,418.47, the FBM Emas Shariah Index was 23.5 factors lower at 11,951.37, and the FBM ACE Index dropped 51.8 factors to 5,015.01.

Sector-wise, the economic services and products index eased 1.24 factors to 186.56, the monetary companies index shed 22.11 factors to 17,363.95, the vitality index was 2.4 factors simpler at 971.4, and the plantation index decreased 7.49 factors to 7,426.05.

The Main Market quantity improved to 2.48 billion models valued at RM2.51 billion versus 2.41 billion models valued at RM2.63 billion yesterday.

Warrants turnover dwindled to 977.13 million models price RM141.19 million in opposition to 1.21 billion models price RM170.48 million yesterday.

The ACE Market quantity shrank to 501.52 million shares price RM177.04 million from 629.57 million shares price RM231.37 million beforehand.

Consumer services and products counters accounted for 495.78 million shares traded on the Main Market, industrial services and products (583.4 million), development (266.24 million), expertise (255.86 million), SPAC (nil), monetary companies (92.72 million), property (258.08 million), plantation (27.71 million), REITs (22.97 million), closed/fund (59,000), vitality (257.9 million), healthcare (43.66 million), telecommunications and media (47.12 million), transportation and logistics (43.03 million), utilities (84.84 million), and enterprise trusts (4.15 million).