KUALA LUMPUR: Bursa Malaysia closed mixed as we speak, and trended inside a good vary as traders exercised warning amid the unstable sentiment throughout the area, mentioned Rakuten Trade Sdn Bhd.

Its vice-president of fairness analysis Thong Pak Leng mentioned Malaysian equities closed mixed after some losses earlier, and shopping for curiosity was seen within the property and tech sectors.

“The benchmark index surged to a brand new 52-week excessive on Monday, closing at 1,555.98.

“Although there was a pullback after the rally, we interpret this correction as a wholesome consolidation essential to maintain the upward development,” he informed eNM.

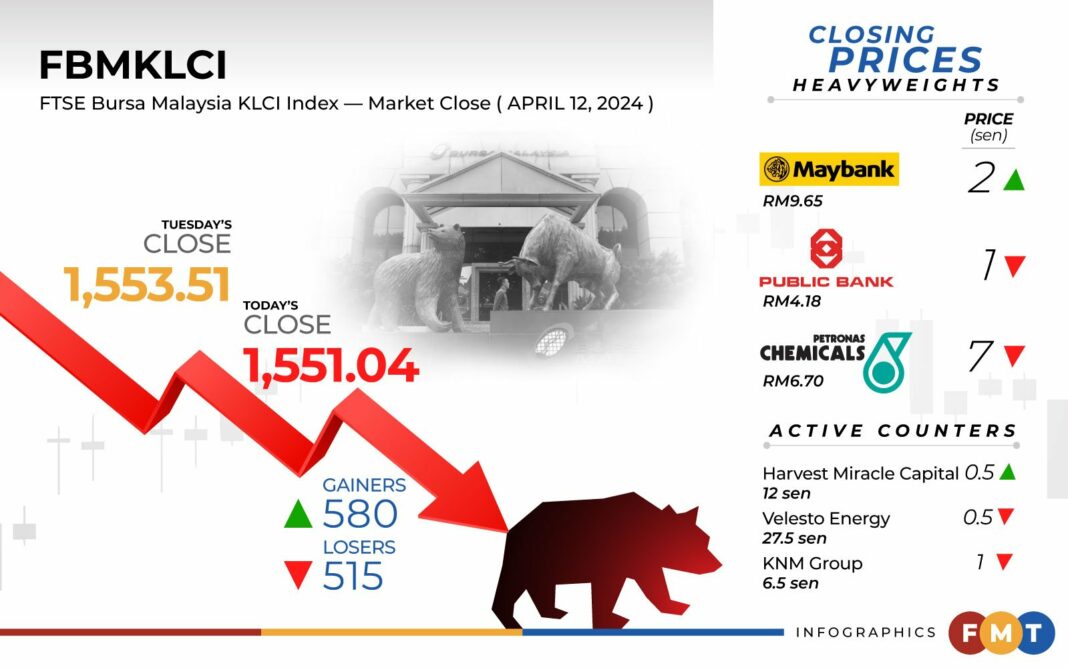

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) declined 2.47 factors or 0.16% to 1,551.04 from Tuesday’s shut of 1,553.51.

The benchmark index opened 0.58 of-a-point greater at 1,554.09 and moved between 1,548.27 and 1,556.64 all through the buying and selling session.

On the broader market, nonetheless, gainers beat decliners 580 to 515, with 470 counters unchanged, 778 untraded, and 11 others suspended.

Turnover rose to three.88 billion items value RM3 billion in contrast with 3.46 billion items valued at RM2.06 billion on Tuesday.

Among the heavyweights, Maybank edged up 2 sen to RM9.65, CIMB Group and Tenaga Nasional superior 4 sen every to RM6.61 and RM11.70, respectively, whereas Public Bank slid 1 sen to RM4.18 and Petronas Chemicals dropped 7 sen to RM6.70.

Among the actives, Harvest Miracle Capital elevated by 0.5 sen to 12 sen, Dagang NeXchange elevated by 4 sen to 41.5 sen, Bina Puri Holdings was flat at 8 sen, Velesto Energy decreased by 0.5 sen to 27.5 sen and KNM Group decreased by 1 sen to six.5 sen.

On the index board, the FBM Emas Index decreased by 3.32 factors to 11,697.82, the FBMT 100 Index declined by 8.54 factors to 11,326.92, the FBM Emas Shariah Index fell by 2.21 factors to 11,862.99.

Meanwhile, the FBM ACE Index surged by 88.96 factors to five,100.12 and the FBM 70 Index rose by 26.77 factors to 16,392.57.

Sector-wise, the monetary companies index elevated by 28.27 factors to 17,271.8 and the economic services index gained 0.85 of-a-point to 184.66.

The plantation index slid by 8.13 factors to 7,470.69 and the vitality index decreased by 1.8 factors to 969.09.

The Main Market quantity rose to 2.16 billion items valued at RM2.65 billion versus 1.88 billion items value RM1.77 billion on Tuesday.

Warrants turnover shrank to 913.7 million items value RM101.73 million in opposition to 1.01 billion items valued at RM115.72 million beforehand.

The ACE Market quantity elevated to 787.74 million shares value RM239.77 million from 569.18 million shares value RM176.42 million beforehand.

Consumer services counters accounted for 335.86 million shares traded on the Main Market, industrial services (335.64 million), building (203.85 million), know-how (310.79 million), SPAC (nil), monetary companies (110.62 million), property (347.86 million), plantation (47.78 million), REITs (10.3 million), closed/fund (61,600), vitality (271.6 million), healthcare (42.02 million), telecommunications and media (50.31 million), transportation and logistics (40.32 million), and utilities (51.27 million).

Bursa Malaysia and its subsidiaries had been closed on Wednesday and Thursday (April 10 and April 11) at the side of the Hari Raya Aidilfitri holidays.