KUALA LUMPUR: Bursa Malaysia ended the week mixed, with shopping for in chosen heavyweights and commodity-related shares, amid the destructive sentiment on regional markets, stated an analyst.

Meanwhile, Rakuten Trade Sdn Bhd fairness analysis vice-president Thong Pak Leng stated the important thing regional indices completed decrease following the rise in commodity costs as a result of considerations over worsening geopolitical circumstances within the Middle East.

Additionally, hawkish statements from US Federal Reserve (Fed) officers added strain to danger urge for food, particularly after Atlanta Fed president Raphael Bostic cautioned that the central financial institution would possibly elevate rates of interest ought to inflation stay at a excessive stage.

“On the home entrance, we strongly advise buyers to train warning in gentle of accelerating market dangers, elevated volatility in world markets, and escalating geopolitical tensions.

“Consequently, we anticipate the benchmark index to additional consolidate till new catalysts emerge,” he advised eNM.

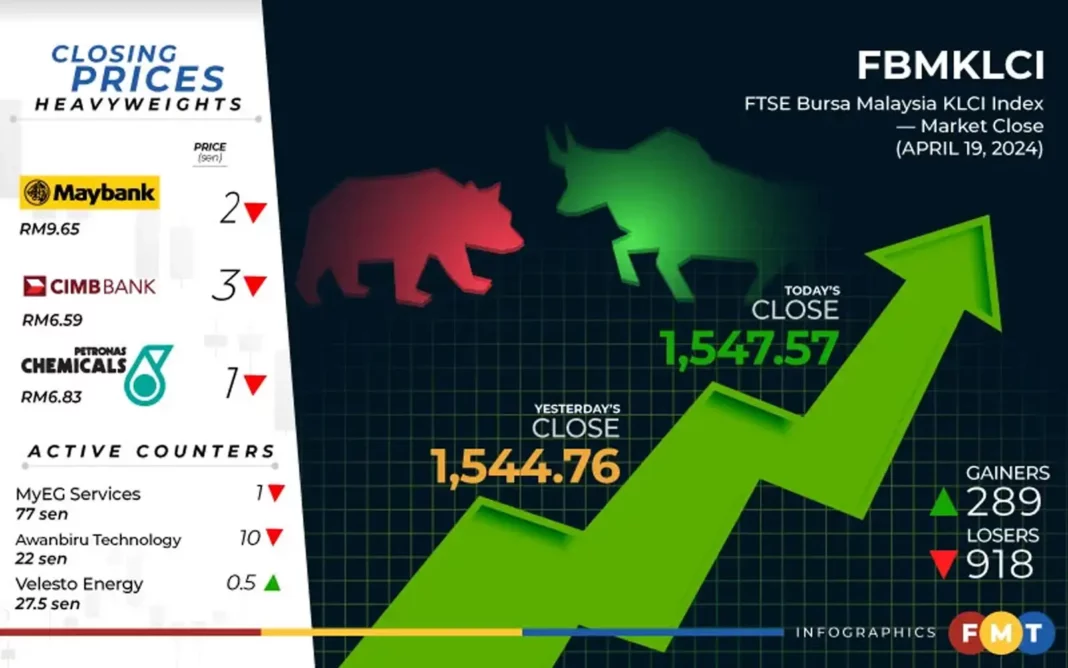

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) rose 2.81 factors, or 0.18%, to 1,547.57 from yesterday’s shut of 1,544.76.

The benchmark index, which opened 1.54 factors higher at 1,546.30, moved between 1,545.90 and 1,552.45 all through the buying and selling session.

The market breadth was destructive with decliners thumping gainers 918 to 289, whereas 416 counters have been unchanged, 753 untraded, and 23 others suspended.

Turnover elevated to 4.71 billion items value RM3.4 billion from 3.84 billion items value RM2.62 billion yesterday.

Regionally, Japan’s Nikkei 225 sank 2.66% to 37,068.35, Hong Kong’s Hang Seng Index slipped 0.99% to 16,224.14, South Korea’s Kospi shed 1.63% to 2,591.86, Singapore’s Straits Times Index eased 0.35% to three,176.51, and China’s SSE Composite Index dipped 0.29% to three,065.26.

Among the heavyweights, Maybank declined two sen to RM9.65, CIMB slid three sen to RM6.56, Petronas Chemicals eased one sen to RM6.83, Public Bank added one sen to RM4.15, and Tenaga Nasional was flat at RM11.60.

As for the actives, TWL Holdings and Bina Puri Holdings have been flat at three sen and eight sen, respectively, MyEG Services inched down one sen to 77 sen, Awanbiru Technology dipped 10 sen to 22 sen, and Velesto Energy perked up 0.5 sen to 27.5 sen.

On the index board, the FBM Emas Index erased 20.9 factors to 11,596.07, the FBM 70 Index tumbled 126.27 factors to 16,058.39, the FBMT 100 Index shed 7.58 factors to 11,247.95, the FBM Emas Shariah Index was 18.46 factors weaker at 11,769.87, and the FBM ACE Index slipped 88.54 factors to 4,858.98.

Sector-wise, the plantation index garnered 21.2 factors to 7,375.65, the commercial services and products index inched up 0.04 of-a-point to 184.49, and the vitality index climbed 17.19 factors to 969.19, however the monetary companies index slid 13.86 factors to 17,118.78.

The Main Market quantity superior to 2.77 billion items valued at RM3.01 billion versus 2.23 billion items valued at RM2.31 billion yesterday.

Warrants turnover expanded to 1.23 billion items value RM164.4 million in opposition to 1.09 billion items value RM152.72 million yesterday.

The ACE Market quantity surged to 702.72 million shares value RM222.46 million from 507.34 million shares value RM162.95 million beforehand.

Consumer services and products counters accounted for 394.74 million shares traded on the Main Market, industrial services and products (555.15 million), building (293.19 million), expertise (389.48 million), SPAC (nil), monetary companies (113.76 million), property (516.7 million), plantation (54.37 million), REITs (21.33 million), closed/fund (107,700), vitality (236.64 million), healthcare (53.79 million), telecommunications and media (31.02 million), transportation and logistics (40.53 million), and utilities (65.82 million).