KUALA LUMPUR: Bursa Malaysia ended buying and selling at an intraday low attributable to weak investor sentiment amid escalating geopolitical tensions within the Middle East, mentioned an analyst.

In addition, Rakuten Trade Sdn Bhd vice-president of fairness analysis Thong Pak Leng mentioned the important thing regional indices have been additionally largely lower, with persistent considerations over higher-for-longer US rates of interest weighing on investor sentiment.

Japan’s Nikkei declined 0.74% to 39,232.8, Singapore’s Straits Times Index slid 1.09% to three,183.61, South Korea’s Kospi slipped 0.42% to 2,670.43, and Hong Kong’s Hang Seng Index shed 0.72% to 16,600.46.

“On the home entrance, we anticipate short-term market sentiment to stay jittery amid uncertainty in international financial efficiency.

“Simultaneously, buyers are suggested to remain alert for bargain-hunting alternatives ought to there be a optimistic final result from the ceasefire talks,” he advised eNM.

As such, Thong anticipates the FTSE Bursa Malaysia KLCI (FBM KLCI) to stay in consolidation and pattern throughout the 1,538-1,570 vary for the week.

Meanwhile, UOB Kay Hian Wealth Advisors’ designated portfolio supervisor and head of wealth analysis and advisory, Sedek Jantan mentioned the FBM KLCI’s efficiency at this time mirrored the continuing promoting stress following the Middle East battle over the weekend.

He mentioned the pattern is anticipated to persist as soon as the US market opens, pushed by persistent inflationary pressures and escalating geopolitical tensions.

“Profit-taking actions are anticipated to proceed all through the week.

“While the disaster within the Middle East just isn’t prone to considerably influence international equities, buyers are anticipated to take a defensive method,” he mentioned.

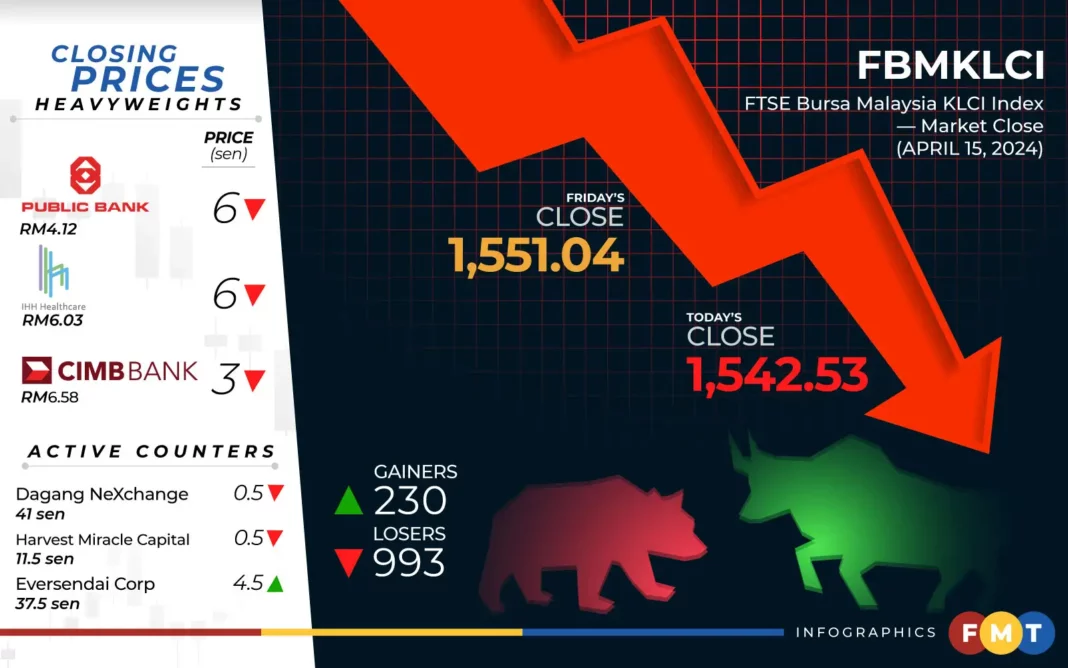

At 5pm, the FBM KLCI fell 8.51 factors, or 0.55%, to 1,542.53 from Friday’s shut of 1,551.04.

The benchmark index opened 5.59 factors lower at 1,545.45 and reached its intraday excessive of 1,548.34 in the course of the mid-morning session.

Market breadth was damaging with decliners main gainers 993 to 230, whereas 374 counters have been unchanged, 755 untraded and 11 others suspended.

Turnover elevated to 4.28 billion items value RM3.25 billion from 3.88 billion items value RM3 billion final Friday.

Among the heavyweights, Maybank was flat at RM9.65, Public Bank and IHH Healthcare misplaced 6 sen to RM4.12 and RM6.03, respectively, CIMB inched down 3 sen to RM6.58, and Tenaga Nasional dipped 10 sen to RM11.60.

As for the actives, Velesto Energy and Bina Puri Holdings have been flat at 27.5 sen and eight sen, respectively. Both Dagang NeXchange and Harvest Miracle Capital eased 0.5 sen to 41 sen and 11.5 sen, respectively, whereas Eversendai Corp gained 4.5 sen to 37.5 sen.

On the index board, the FBM Emas Index went down 97.62 factors to 11,600.2, the FBMT 100 Index fell 87.86 factors to 11,239.06, and the FBM 70 Index tumbled 232.72 factors to 16,159.85.

The FBM ACE Index declined 103.65 factors to 4,996.47 and the FBM Emas Shariah Index decreased 106.41 factors to 11,756.58.

Sector-wise, the plantation index gave up 38.07 factors to 7,432.62, the commercial services index eased 0.84 of-a-point to 183.82, the monetary providers index sank 102.65 factors to 17,169.15, and the power index slipped 2.6 factors to 966.49.

The Main Market quantity rose to 2.42 billion items valued at RM2.88 billion versus 2.16 billion items valued at RM2.65 billion final Friday.

Warrants turnover improved to 1.12 billion items value RM121.17 million towards 913.7 million items value RM101.73 million beforehand.

The ACE Market quantity dwindled to 723.24 million shares value RM241.84 million from 787.74 million shares value RM239.77 million on Friday.

Consumer services counters accounted for 400.07 million shares traded on the Main Market, industrial services (465.87 million), building (333.55 million), expertise (238.23 million), SPAC (nil), monetary providers (104.39 million), property (388.51 million), plantation (70.33 million), REITs (24.01 million), closed/fund (31,200), power (203.48 million), healthcare (58.92 million), telecommunications and media (40.68 million), transportation and logistics (34.24 million), and utilities (54.29 million).