KUALA LUMPUR: Bursa Malaysia closed lower in the present day, weighed by selling pressure in telecommunication, plantation, and gaming shares.

Meanwhile, Rakuten Trade Sdn Bhd fairness analysis vice-president Thong Pak Leng stated the FTSE Bursa Malaysia KLCI (FBM KLCI) confronted selling pressure as buyers shifted their concentrate on small-cap shares within the transportation and logistics, property, and building sectors.

“Major regional indices additionally ended lower as sentiment remained cautious forward of key financial readings this week, together with China’s Purchasing Managers’ Index and US inflation information,” he stated.

Thong suggested buyers to proceed with warning and think about exterior components equivalent to rising market dangers in addition to elevated volatility in world markets.

“We anticipate the FBM KLCI to stay in consolidation mode in the interim till recent catalysts emerge.

“Consequently, we count on it to pattern inside the 1,530-1,550 vary for the week, with fast assist at 1,530 and resistance at 1,560,” he informed eNM.

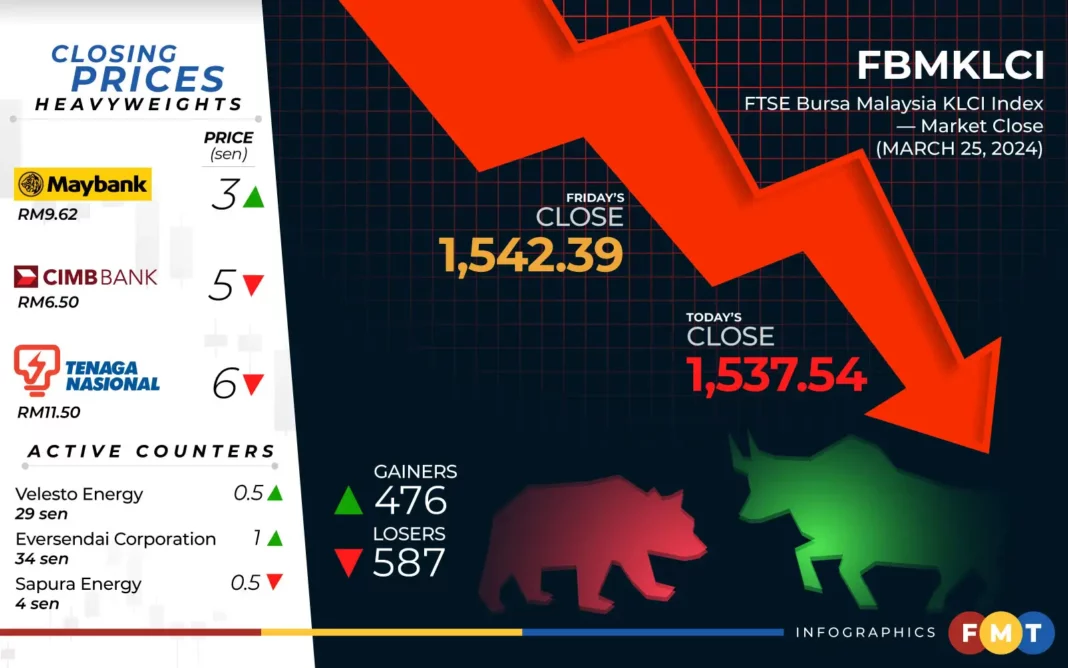

At 5pm, the FBM KLCI declined by 4.85 factors to 1,537.54 from Friday’s shut of 1,542.39.

The benchmark index opened 2.16 factors lower at 1,540.23 and moved in a decent vary between 1,532.73 and 1,540.23 all through the day.

On the broader market, losers beat gainers 587 to 476, whereas 456 counters had been unchanged, 817 untraded, and 37 others suspended.

Turnover fell to 3.59 billion items price RM2.49 billion from 5.08 billion items price RM2.69 billion on Friday.

Among the heavyweights, Maybank added three sen to RM9.62, Public Bank was flat at RM4.24, whereas CIMB Group declined 5 sen to RM6.50, Tenaga Nasional slid six sen to RM11.50, and Petronas Chemicals eased one sen to RM6.78.

As for the actives, Velesto Energy and TWL Holdings added 0.5 sen every to 29 sen and three sen respectively, Eversendai Corporation gained one sen to 34 sen, whereas Sapura Energy slipped 0.5 sen to 4 sen, and Alpha IVF shed one sen to 31 sen.

On the index board, the FBM Emas Index dipped 14.11 factors to 11,540.99, the FBMT 100 Index was 15.53 factors lower at 11,188.65, the FBM Emas Shariah Index misplaced 20.75 factors to 11,631.23, whereas the FBM 70 Index surged 59.17 factors to 16,029.87 and the FBM ACE Index perked up 24.53 factors to 4,880.87.

Sector-wise, the plantation index slipped 20.23 factors to 7,316.44, the commercial services index trimmed 0.11 of-a-point to 178.62, the monetary companies index shed 9.95 factors to 17,178.93, whereas the power index gained 5.03 factors to 939.37.

The Main Market quantity dwindled to 2.36 billion items valued at RM2.26 billion from 3.35 billion items valued at RM2.27 billion on Friday.

Warrants turnover declined to 585.33 million items price RM82.39 million from 877.09 million items price RM117.79 million final Friday.

The ACE Market quantity tumbled to 777.06 million shares price RM207.82 million from 858.13 million shares price RM296.59 million beforehand.

Stay present – Follow eNM on WhatsApp, Google information and Telegram

Consumer services counters accounted for 246.17 million shares traded on the Main Market, industrial services (428.29 million); building (293.54 million); expertise (154.99 million); SPAC (nil); monetary companies (94.97 million); property (421.14 million); plantation (71.03 million); REITs (19.98 million), closed/fund (62,800); power (384.29 million); healthcare (53.91 million); telecommunications and media (35.05 million); transportation and logistics (59.06 million); and utilities (44.82 million).