KUALA LUMPUR: Bursa Malaysia completed lower at this time, dampened by selling in chosen heavyweights in addition to mid-and small-cap shares, a supplier stated.

Rakuten Trade vice-president of fairness analysis Thong Pak Leng stated the important thing regional indices additionally trended downward as traders exercised warning forward of upcoming inflation information from the US and Europe later this week.

The 7.8% year-on-year decline in China’s industrial earnings in October additional weakened investor sentiment, fuelling impatience over the potential for extra stimulus measures from Beijing.

“While a sequence of weak Purchasing Managers’ Index in Japan raised issues a few slowdown in enterprise exercise within the nation,” he stated.

On the home entrance, Thong stated the valuation of the benchmark index stays enticing at its present degree, and he anticipated continued inventory accumulation, significantly in blue-chip shares throughout market dips.

“However, investor sentiment could also be affected by unsure world financial situations and growing market volatility. Hence, we anticipate the FTSE Bursa Malaysia KLCI (FBM KLCI) to keep up its consolidation part for the second, awaiting the emergence of recent catalysts.

“We anticipate the index to pattern throughout the vary of its assist and resistance ranges, particularly at 1,445 and 1,465, respectively, for the week,” he instructed eNM.

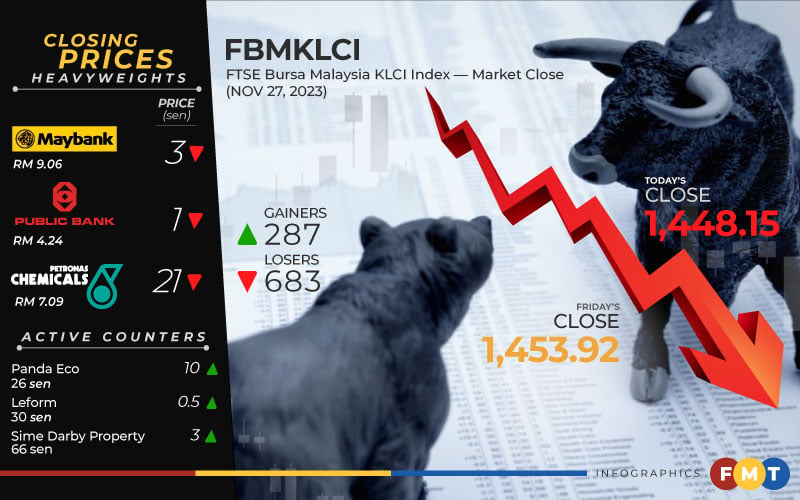

At 5pm, the barometer index declined 5.77 factors to 1,448.15 from Friday’s closing of 1,453.92.

The index opened 0.77 of-a-point weaker at 1,453.15 and moved between 1,448 and 1,455.78 all through the day.

Market breadth was damaging, with decliners outpacing gainers 683 to 287, whereas 415 counters have been unchanged, 1,025 untraded and 48 others suspended.

Turnover fell barely to three.09 billion items valued at RM2.05 billion from 3.5 billion items valued at RM2.35 billion on Friday.

Among the heavyweights, Maybank misplaced three sen to RM9.06, Public Bank went down one sen to RM4.24, Petronas Chemicals fell 21 sen to RM7.09, and Tenaga Nasional dipped 16 sen to RM9.84, whereas CIMB was unchanged at RM5.75.

Of the actives, Panda Eco placed on 10 sen to 26 sen, Leform went up 0.5 sen to 30 sen, Hong Seng and Widad have been flat at 2.5 sen and 46.5 sen, respectively, Top Glove slid two sen to 88 sen, and Sime Darby Property gained three sen to 66 sen.

On the index board, the FBM Emas Index was 43.27 factors lower at 10,725.46, the FBMT 100 Index slid 40.27 factors to 10,390.62 and the FBM Emas Shariah Index declined 69.95 factors to 10,874.06.

The FBM 70 Index decreased by 50.4 factors to 14,281.34 and the FBM ACE Index slipped by 98.06 factors to five,107.37.

Sector-wise, the monetary providers index slipped 42.42 factors to 16,341.9, the vitality index dipped 4.17 factors to 830.68, and the economic services index eased 1.87 factors to 172.24, whereas the plantation index elevated by 12.1 factors to six,943.45.

The Main Market quantity trimmed to 1.82 billion items valued at RM1.71 billion from 2.09 billion items valued at RM2.04 billion on Friday.

Warrants turnover tumbled to 496.1 million items valued at RM63.91 million towards 710.88 million items valued at RM87.76 million beforehand.

The ACE Market quantity rose to 776.51 million shares value RM279.85 million versus 677.28 million shares value RM223.46 million final Friday.

Consumer services counters accounted for 301.49 million shares traded on the Main Market, industrial services (408.24 million); building (119.99 million); expertise (257.33 million); SPAC (nil); monetary providers (47.98 million); property (262.56 million); plantation (31.73 million); REITs (7.07 million), closed/fund (22,900); vitality (111.27 million); healthcare (131.8 million); telecommunications and media (27.23 million); transportation and logistics (36.46 million); and utilities (76.01 million).