KUALA LUMPUR: Bursa Malaysia ended the week on a firmer notice at the moment, bucking the principally decrease regional market efficiency, on persistent shopping for in utilities shares, mentioned an analyst.

UOB Kay Hian Wealth Advisors’ designated portfolio supervisor and head of wealth analysis and advisory, Sedek Jantan mentioned the FTSE Bursa Malaysia KLCI (FBM KLCI) noticed an uptick, propelled by the ongoing bearish trend of the dollar.

He mentioned this momentum was fuelled by the post-Federal Open Market Committee’s hawkish adjustment of the Federal Reserve’s fee projections, exerting downward stress on the dollar.

“Moreover, the know-how sector spearheaded at the moment’s market beneficial properties, buoyed by Apple’s surpassing revenue efficiency within the first quarter of 2024 and the disclosing of a US$110 billion (RM521.40 billion) share buyback programme, alongside Microsoft’s substantial investments in Malaysia,” he informed eNM.

Regionally, Hong Kong’s Hang Seng Index rose 1.48% to 18,475.92, China’s SSE Composite Index dipped 0.26% to three,104.82, South Korea’s Kospi eased 0.26% to 2,676.63, and Singapore’s Straits Times Index shed 0.12% to three,292.93.

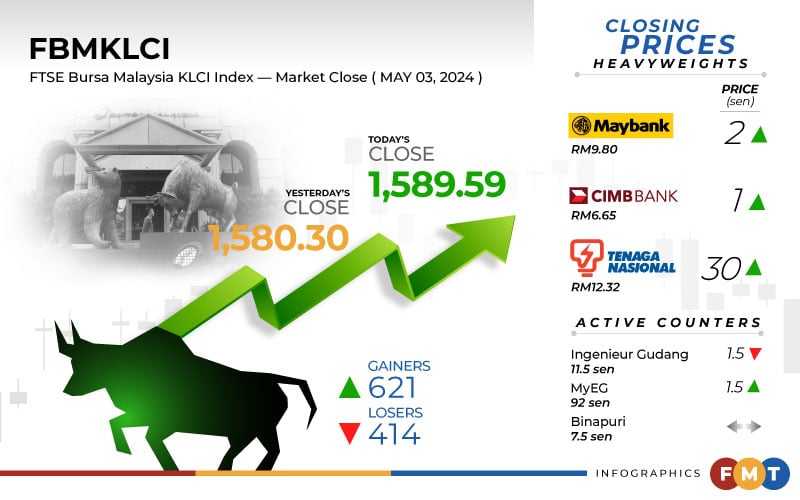

At 5pm, the FBM KLCI rose 9.29 factors or 0.59% to 1,589.59 from yesterday’s shut of 1,580.30.

The benchmark index opened 1.29 factors increased at 1,581.59 and moved between 1,581.59 and 1,590.56 all through the day.

In the broader market, gainers outpaced decliners 621 to 414, with 460 counters unchanged, 803 untraded, and 20 others suspended.

Turnover improved to three.87 billion items price RM3.15 billion from 3.81 billion items price RM3.06 billion yesterday.

Back residence, heavyweights Maybank and Public Bank bagged two sen every to RM9.80 and RM4.12, respectively, CIMB improved one sen to RM6.65, Tenaga Nasional rose 30 sen to RM12.32, whereas IHH Healthcare misplaced 4 sen to RM6.29.

As for the actives, Ingenieur Gudang eased 1.5 sen to 11.5 sen, MyEG edged up 1.5 sen to 92 sen, whereas Fitters, TWL, and Binapuri had been all flat at 5 sen, three sen, and seven.5 sen, respectively.

On the index board, the FBM Emas Index soared 74.02 factors to 11,970.11, the FBMT 100 Index jumped 72.29 factors to 11,597.12, the FBM 70 Index surged 122.83 factors to 16,737.02, the FBM Emas Shariah Index elevated 79.71 factors to 12,193.3, and the FBM ACE Index rose 26.87 factors to five,134.55.

Sector-wise, the monetary providers index climbed 47.15 factors to 17,290.41, the commercial services index edged up 0.81 of-a-point to 190.84, the power index perked up 2.91 factors to 966.85, whereas the plantation index dropped 35.32 factors to 7,419.87.

The Main Market quantity expanded to 2.38 billion items valued at RM2.79 billion versus 2.14 billion items valued at RM2.7 billion yesterday.

Warrants turnover slipped to 929.71 million items price RM148.76 million towards 1.19 billion items price RM157.99 million yesterday.

The ACE Market quantity superior to 560.13 million shares price RM210.14 million from 478.56 million shares price RM196.65 million beforehand.

Consumer services counters accounted for 339 million shares traded on the Main Market, industrial services (649.48 million), development (217.87 million), know-how (262.84 million), SPAC (nil), monetary providers (116.33 million), property (328.14 million), plantation (32.88 million), REITs (19.28 million), closed/fund (114,300), power (121.65 million), healthcare (78.7 million), telecommunications and media (44.44 million), transportation and logistics (49.78 million), utilities (1.20 million), and enterprise trusts (684,700).