KUALA LUMPUR: Bursa Malaysia continued its uptrend to shut higher, monitoring the upbeat efficiency of regional friends, amid strong buying support from international funds in addition to native establishments, stated an analyst.

Rakuten Trade Sdn Bhd vice-president of fairness analysis Thong Pak Leng stated the important thing regional indices ended higher as international funds continued to circulation into the area amid risk-on mode as traders took constructive cues from Wall Street’s efficiency final Friday.

“The rally within the area was spearheaded by Hong Kong and Chinese shares, propelling the Hang Seng Index in the direction of the technical bull market territory,” he famous.

These beneficial properties, he opined, indicated a rejuvenation out there which was beforehand struggling however is now supported by a resurgence in international investments and stronger earnings.

“As for the native bourse, we keep a constructive stance on the resurgence of world funds into the area, accompanied by sturdy company earnings.

“Nonetheless, we stay cautious about potential profit-taking actions,” he stated.

Therefore, he stated that he expects the FTSE Bursa Malaysia KLCI (FBM KLCI) to fluctuate throughout the 1,570-1,590 vary for the week, with speedy resistance seen at 1,600 and support ranges at 1,560 and 1,545.

“Additionally, we anticipate resistance on the psychological threshold of 1,600,” he informed eNM.

Regionally, Japan’s Nikkei 225 rose 0.81% to 37,934.76, Hong Kong’s Hang Seng Index rose 0.54% to 17,746.91 and South Korea’s Kospi surged 1.17% to 2,687.44, China’s SSE Composite Index garnered 0.79% to three,113.04, and Singapore’s Straits Times Index improved 0.06% to three,282.05.

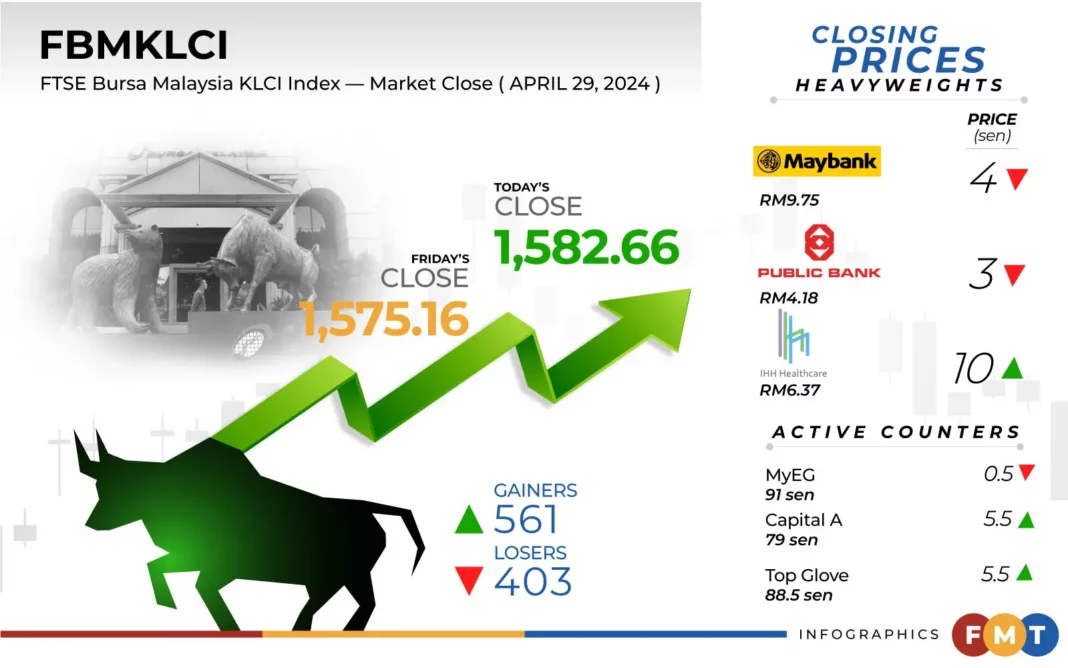

At 5pm, the FBM KLCI rose 7.5 factors to 1,582.66 from final Friday’s shut of 1,575.16.

The benchmark index opened 1.14 factors higher at 1,576.30 and moved between 1,575 and 1,583.34 all through the day.

On the broader market, gainers beat decliners 561 to 403 whereas 616 counters have been unchanged, 793 untraded, and 112 others suspended.

Turnover improved to 4.24 billion models price RM3.25 billion from 4.11 billion models price RM3.25 billion final Friday.

Among the heavyweights, Maybank shed 4 sen to RM9.75, Public Bank slid 3 sen to RM4.18, and IHH Healthcare gained 10 sen to RM6.37.

CIMB and Tenaga Nasional have been flat at RM6.61 and RM11.92, respectively.

As for the actives, MyEG shaved off 0.5 sen to 91 sen, Capital A and Top Glove elevated 5.5 sen every to 79 sen and 88.5 sen, respectively, whereas TWL Holdings and Bina Puri have been flat at 3 sen and seven.5 sen, respectively.

On the index board, the FBM Emas Index was 74.23 factors higher at 11,901.02, the FBMT 100 Index elevated 73.81 factors to 11,535.26, and the FBM 70 Index surged 184.71 factors to 16,601.49.

The FBM Emas Shariah Index soared 92.53 factors to 12,084.48 and the FBM ACE Index jumped 30 factors to five,092.01.

Sector-wise, the vitality index put on 3.07 factors to 980.49, the plantation index elevated 56.32 factors to 7,459.27, the economic services and products index climbed 1.25 factors to 188.58 however the monetary providers index slipped 30.41 factors to 17,273.4.

The Main Market quantity declined to 2.46 billion models valued at RM3.11 billion versus 2.59 billion models valued at RM2.92 billion final Friday.

Warrants turnover expanded to 1.18 billion models price RM174.02 million in opposition to 1.06 billion models price RM157.29 million beforehand.

The ACE Market quantity swelled to 596.31 million shares price RM195.33 million from 452.36 million shares price RM167.36 million final Friday.

Consumer services and products counters accounted for 343.46 million shares traded on the Main Market, industrial services and products (463.49 million), development (238.73 million), expertise (379.31 million), SPAC (nil), monetary providers (92.64 million), property (363.53 million), plantation (30.03 million), REITs (19.43 million), closed/fund (95,800), vitality (140.18 million), healthcare (150.06 million), telecommunications and media (48.06 million), transportation and logistics (40.1 million), utilities (147.7 million), and enterprise trusts (514,600).