KUALA LUMPUR: Bursa Malaysia continued its upbeat momentum to finish higher for the fifth consecutive day, thanks to purchasing from native and international establishments, stated an analyst.

Rakuten Trade Sdn Bhd fairness analysis vice-president Thong Pak Leng stated key regional indices additionally ended higher following the constructive cue from international equities on hope for sturdy earnings from tech giants this week.

He stated sturdy earnings are anticipated to assist offset worries in regards to the Federal Reserve’s rate of interest plans forward of the discharge of key US development and inflation information whereas on the similar time, traders are inspired after Middle East tensions eased.

“On the home entrance, the FTSE Bursa Malaysia KLCI (FBM KLCI) is on its strategy to take a look at the 1,570 resistance and we reckon if this degree is breached and capable of maintain for an extended interval, we consider that the benchmark index is positioned to advance additional.

“As such, we anticipate the FBM KLCI to pattern throughout the vary of 1,550-1,570 for the remainder of the week,” he advised eNM.

Meanwhile, UOB Kay Hian Wealth Advisors’ designated portfolio supervisor and head of wealth analysis and advisory Sedek Jantan stated the FBM KLCI closed barely higher at present after reaching a peak of 1567.42 within the morning session, marking the very best degree for this yr.

“Today’s shut of the FBM KLCI displays a constructive pattern, pushed by encouraging indicators of easing tensions within the Middle East.

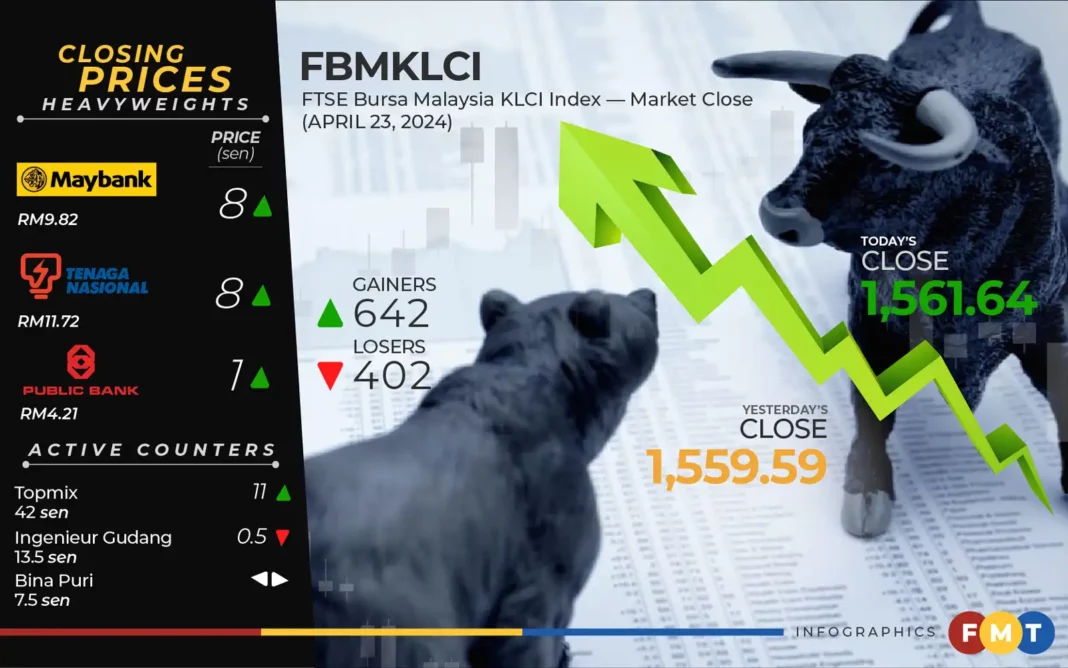

“The benchmark index noticed an uptick of two.05 factors or 0.13%, reaching 1,561.64 factors by the shut of buying and selling,” he stated.

Sedek stated that with the ringgit stabilising and a steady stream of constructive information, the outlook for Malaysian equities stays brilliant.

“Progress in home reform initiatives is poised to draw and nurture new sources of international direct funding (FDI).

“The KL20 Summit, spanning yesterday and at present, underscores the federal government’s dedication to catalysing the know-how ecosystem,” he added.

At 5pm, the FBM KLCI rose 2.05 factors to 1,561.64 from yesterday’s shut of 1,559.59.

The benchmark index, which opened 0.22 of-a-point higher at 1,559.81, moved between 1,559.81 and 1,567.57 all through the buying and selling session.

On the broader market, gainers thumped decliners 642 to 402, whereas 507 counters had been unchanged, 823 untraded, and 22 others suspended.

Turnover improved to three.73 billion models value RM2.79 billion from 3.49 billion models value RM2.53 billion yesterday.

Among the heavyweights, Maybank and Tenaga Nasional gained eight sen every to RM9.82 and RM11.72 respectively, Public Bank elevated one sen to RM4.21, CIMB went up 5 sen to RM6.67, and Petronas Chemicals was two sen higher to RM6.83.

As for the actives, ACE Market debutant Topmix edged up 11 sen to 42 sen, Ingenieur Gudang inched down 0.5 sen to 13.5 sen, whereas Bina Puri, Sapura Energy, and Fitters Diversified had been flat at 7.5 sen, 4.5 sen and 5 sen.

On the index board, the FBM Emas Index jumped 31.42 factors to 11,715.04, the FBM 70 Index superior 94.11 factors to 16,249.04, the FBMT 100 Index put on 28.02 factors to 11,358.26, the FBM Emas Shariah Index strengthened 22.94 factors to 11,858.35, and the FBM ACE Index recovered 28.81 factors to 4,958.15.

Sector-wise, the economic services and products index inched up 0.48 of-a-point to 185.56, the monetary providers index surged 86.06 factors to 17,355.35, the power index was 2.96 factors decrease at 969.16, and the plantation index decreased 32.24 factors to 7,383.95.

The Main Market quantity widened to 2 billion models valued at RM2.42 billion versus 1.95 billion models valued at RM2.22 billion yesterday.

Warrants turnover slid to 935.1 million models value RM114.23 million towards 979.82 million models value RM119.15 million yesterday.

The ACE Market quantity expanded to 783.91 million shares value RM251.55 million from 558.35 million shares value RM187.78 million beforehand.

Consumer services and products counters accounted for 306.76 million shares traded on the Main Market, industrial services and products (460.2 million), building (187.9 million), know-how (230.73 million), SPAC (nil), monetary providers (95.68 million), property (252.03 million), plantation (32.92 million), REITs (16.2 million), closed/fund (2,000), power (223.14 million), healthcare (84.56 million), telecommunications and media (30.25 million), transportation and logistics (31.38 million), utilities (48.97 million), and enterprise belief (1.15 million).