KUALA LUMPUR: Bursa Malaysia continued its upward trajectory right now to finish at its highest stage in virtually a 12 months on robust buying in heavyweights led by YTL Corporation and YTL Power International, stated an analyst.

The key regional indices additionally ended increased as discount searching emerged following the latest sell-off with a deal with monetary shares.

Meanwhile, Rakuten Trade Sdn Bhd vice-president of fairness analysis Thong Pak Leng stated concurrently, strong indications from the US labour market information launched yesterday had been influencing the panorama of expectations for interest-rate cuts.

Investors had been betting that the US Federal Reserve (Fed) would minimize interest charges by twice as a lot this 12 months because the central financial institution has indicated.

“Back house, our optimism persists, fuelled by beneficial market indicators as we aspire for the benchmark index to stay above the 1,465 stage for an prolonged interval, a threshold it struggled to take care of a number of occasions final 12 months,” Thong informed eNM.

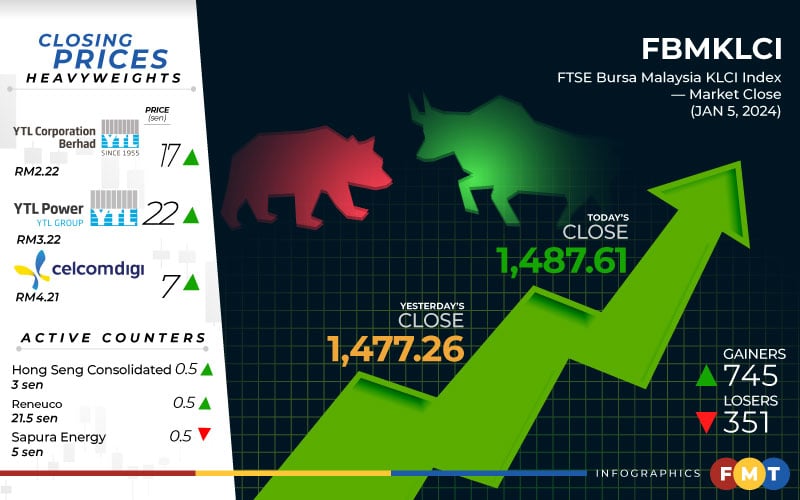

At 5pm right now, the FTSE Bursa Malaysia KLCI (FBM KLCI) soared 0.7% or 10.35 factors to settle at its intraday excessive of 1,487.61 from yesterday’s shut of 1,477.26.

The benchmark index opened 0.37 of-a-point decrease at 1,476.89 and reached a low of 1,476.85 in the early morning session earlier than gaining steam to pattern upwards all through the remainder of the day.

On the broader market, gainers trounced losers 745 to 351, whereas 417 counters had been unchanged, 707 untraded, and 17 others suspended.

Today’s turnover hit one other excessive in over a 12 months at 6.62 billion items price RM3.72 billion in contrast with 6.37 billion items valued at RM3.82 billion yesterday.

Among heavyweights, YTL Corporation superior 17 sen to RM2.22, YTL Power International elevated 22 sen to RM3.22, Celcomdigi and Axiata each rose 7 sen to RM4.21 and RM2.56 respectively, Public Bank added 4 sen to RM4.33, whereas CIMB and Mr DIY had been up by 5 sen every to RM6.00 and RM1.49 respectively.

Of the actives, Hong Seng Consolidated and Minetech gained 0.5 sen every to three sen and 21.5 sen respectively, Sapura Energy fell 0.5 sen to five sen, Luster perked up 2 sen to eight.5 sen, and Sarawak Cable ticked up 4 sen to 42.5 sen.

On the index board, the FBM ACE Index expanded 50.38 factors to five,438.27, the FBM Emas Index elevated 93.08 factors to 11,097.22 and the FBMT 100 Index climbed 89.2 factors to 10,744.37.

The FBM 70 Index surged 183.96 factors to fifteen,059.87 and the FBM Emas Shariah Index expanded 64.44 factors to 11,232.14.

Sector-wise, the property index added 10.39 factors to 925.76, the vitality index rose 5.33 factors to 839.82 and the commercial services index gave up 0.11 of-a-point to 176.99.

The monetary companies index jumped 117.13 factors to 16,582.33 whereas the plantation index eased 6.65 factors to 7,030.92.

The Main Market quantity elevated to 4.52 billion items valued at RM3.3 billion towards 4.44 billion items price RM3.43 billion yesterday.

Warrants turnover decreased to 714.25 million items price RM88.62 million from 770.91 million items valued at RM92.22 million beforehand.

The ACE Market quantity widened to 1.36 billion shares valued at RM341.15 million versus 1.12 billion shares price RM297.69 million yesterday.

Consumer services counters accounted for 483.33 million shares traded on the Main Market, industrial services (1.46 billion); building (267.15 million); expertise (683.34 million); SPAC (nil); monetary companies (83.64 million); property (407.28 million); plantation (19.85 million); REITs (11.84 million), closed/fund (6,900); vitality (418.48 million); healthcare (281.24 million); telecommunications and media (59.44 million); transportation and logistics (129.68 million); and utilities (206.74 million).